Most businesses can attract new customers simply by offering more products on their shelves or expanding the services their staff provides.

For collision repair and body shops, however, growth is more complex. Increasing skills or capabilities does not automatically bring more customers through the front door. Instead, body shops operate in a unique situation: their success often depends on which insurance companies they can accept.

This unique dynamic changes the standard, traditional business priorities other industries enjoy.

While improving the quality and scope of your services is always important, it is no longer the primary way to attract new customers. After an accident, most potential customers will only seek estimates from shops that accept their insurance, usually from a list provided directly from their insurer.

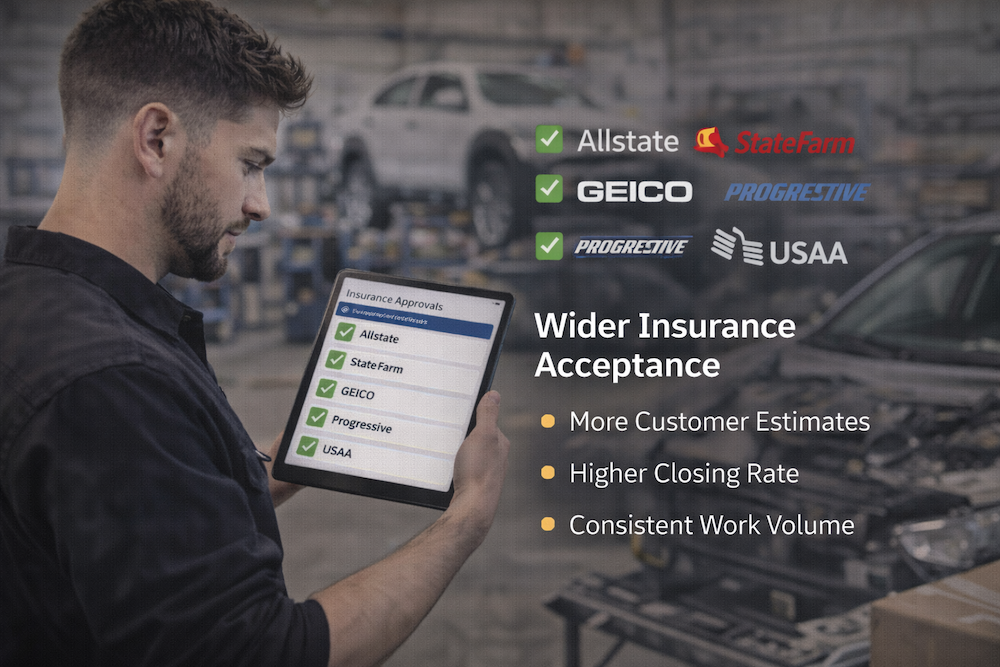

Because of this, being listed as an approved shop by multiple insurers is a critical factor to even be considered by the majority of your prospective clients.

With this in mind, investing time, resources, and energy into becoming an accepted repair shop for a wider range of insurance providers can provide a higher return for your time and effort than simply purchasing new equipment. Fortunately, gathering the required documents and meeting insurer requirements does not have to be a burden anymore. Modern, body shop–focused management software can track invoices, employee skill sets, equipment certifications, and past jobs, making the process much faster and more manageable. In this way, adopting specialized shop management software not only improves efficiency across your team but also provides a strong foundation for expanding insurance acceptance and bringing more customers through your doors day after day.