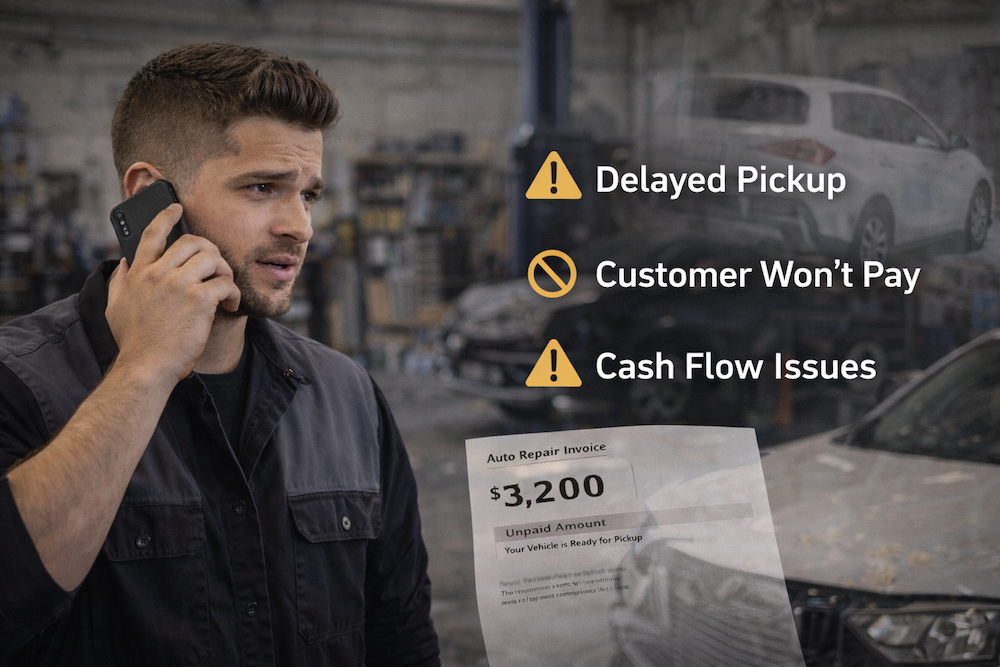

You finished a $3,200 bumper-and-quarter-panel repair two weeks ago. The car is ready. You have called four times.

The customer keeps saying, “I’ll pick it up this weekend.” Yet the car is still sitting in your lot. You still have not been paid.

This is no longer a customer issue. It is a cash flow issue.

Now you are storing a completed vehicle for free while waiting on money you earned weeks ago.

How shops get stuck here

Most unpaid jobs fall into the same patterns.

-

A customer owes a deductible and promises to pay at pickup. Pickup keeps getting delayed. Payment never comes.

-

A supplement gets partially approved. The customer owes the difference. You invoice them after release. They disappear.

In the worst cases, the customer stops responding entirely. Many shops have at least one completed vehicle unpaid right now.

Why does this keep happening

Most shops operate on trust. Most customers are honest.

But honest customers still delay. Paying you is rarely urgent compared to rent, groceries, or credit cards. When payment has no deadline, it slides.

The real mistake is simple: Payment became optional instead of required.

The real cost

Let’s run the math:

-

At 40 jobs per month and a $500 average deductible, just three delayed payments mean $1,500 stuck in receivables every month. That is $18,000 per year.

-

Add small supplement balances. Five $200 unpaid supplements per month adds another $12,000 annually.

-

Add write-offs. Even a 2% loss rate on $3,500 jobs costs nearly $3,000 per year.

That is over $30,000 in cash you earned but cannot use. For a small shop, that is payroll pressure.

The fix: 3 Steps to control payment before pickup

Step 1: Require payment before scheduling pickup

When the job is complete, send a simple message.

-

“Your car is ready. Here is your invoice and payment link. Once payment clears, you can schedule pickup.”

This removes “I’ll bring a check next week” delays entirely. Payment happens before the keys move.

Step 2: Make payment easy anywhere

Customers show up early or unexpectedly. You may be busy or under a vehicle.

Tap-to-pay on your phone solves this. Ten seconds. No terminal. No excuses.

The easier you make it to pay, the faster you get paid.

Step 3: Remove affordability as a delay

Big deductibles cause hesitation.

Offer two options.

-

Financing for customers who want monthly payments.

-

Short layaway for customers who need time instead of credit.

You get paid. The customer gets flexibility. You do not carry the risk.

Set expectations upfront

Add one line to the intake paperwork: “Payment is required before vehicle pickup. Storage fees apply after 7 days.” Most problems disappear when expectations are clear early.

Shops that treat payment as optional chase money.

Shops that treat payment as required get paid faster and stay in control.