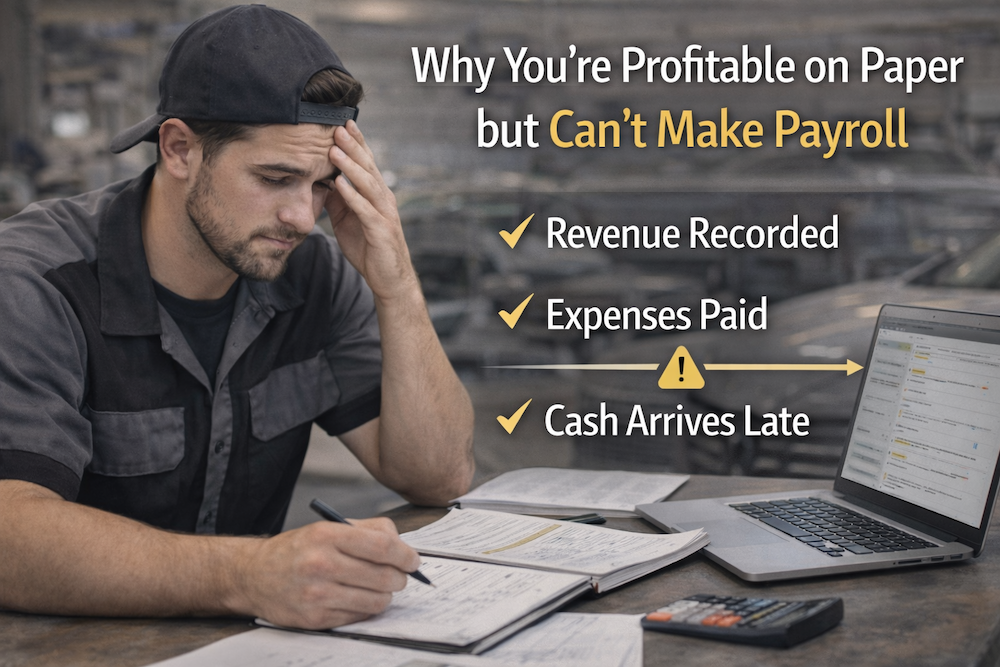

You do a quick run of the numbers. Last month showed $95,000 in revenue. Expenses are $78,000. Profit is $17,000. On paper, the shop is healthy. In reality, payroll on Friday feels uncertain.

This disconnect is common in auto body shops.

Why This Keeps Happening

U.S. Bank research found that 82% of small business failures are tied to cash flow problems, not lack of profitability. Most of these businesses were technically profitable when they failed.

Auto body shops are especially exposed because cash moves slower than expenses.

Revenue is recorded when a job is billed, but the cash often arrives weeks later, sometimes delayed further by slow payment or late vehicle pickup.

The Real Gap Between Profit and Cash

A typical insurance repair shows this clearly.

A $10,000 repair hits your books immediately. But the cash does not follow the same timeline.

-

Insurance may release 60% upfront.

-

Another 30% is delayed by supplements and approvals.

-

The remaining 10% sits in customer deductibles.

At the same time, costs move fast.

-

Parts are often paid upfront before teardown.

-

Payroll runs weekly.

-

Rent, utilities, and software subscriptions are fixed and non-negotiable in most cases.

Auto body industry data shows that 30–60 days cash-conversion cycles are normal for collision repair. This means money goes out today and returns one to two months later.

On paper, the job is profitable. In cash terms, the shop can be negative for weeks.

Why Shops Misread the Risk

Most shop owners review performance monthly, and cash problems develop weekly or even daily.

Strong Books hide timing risk. Delayed supplements, slow insurer responses, and uncollected deductibles quietly stack up. Shops often believe they have a small turbulence. In reality, they have a timing problem.

The Pattern to Notice

The issue is not poor work or weak demand. It is the mismatch between how accounting reports success and how cash actually moves.

Profit measures performance. Cash determines survival.

Until those are viewed as separate realities, the cash flow pressure never fully goes away.